Investments - how we invest your assets

Update June 30, 2023

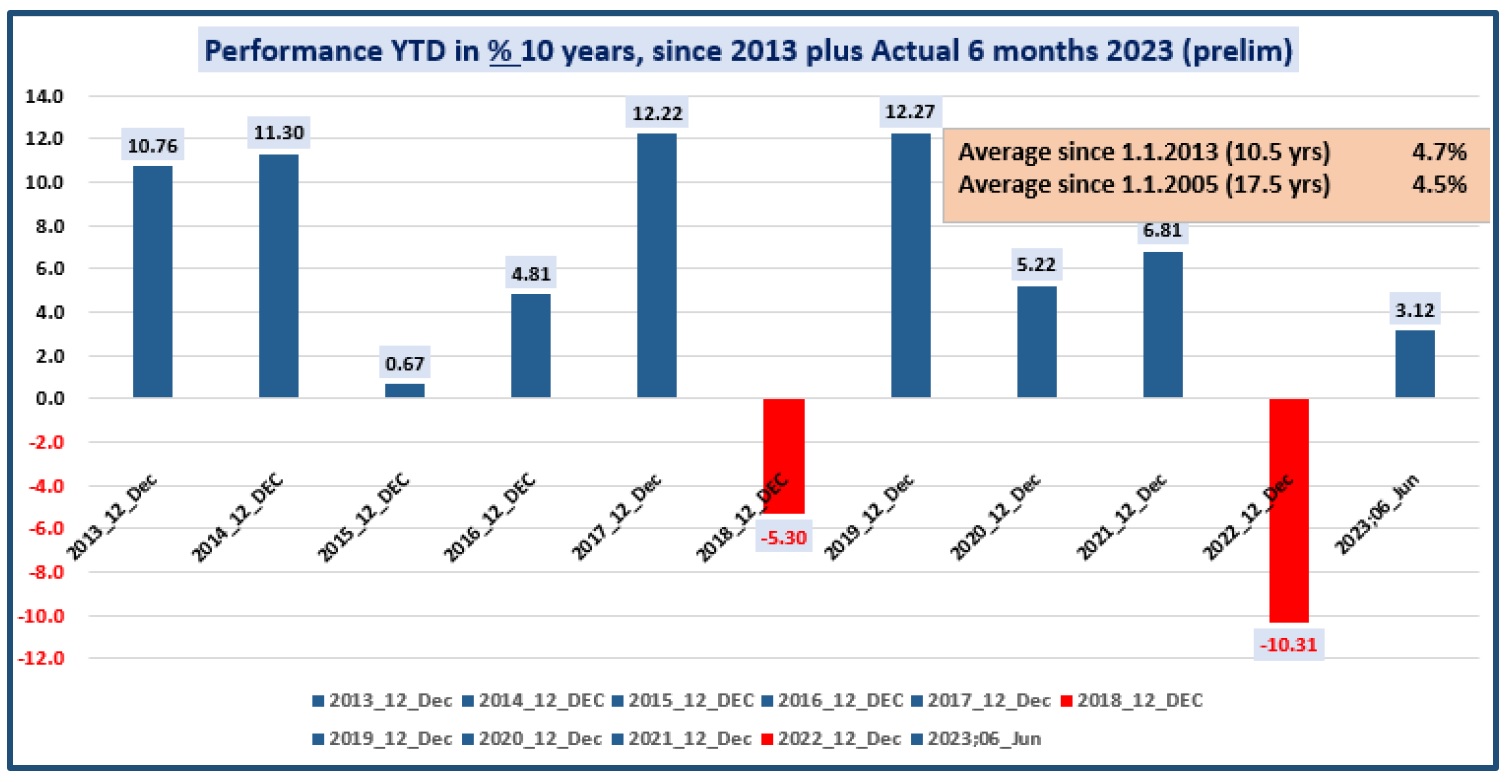

We are on track to achieve our target of 3.6% performance ("profit from investments") from our strategy with a high proportion of bonds of 42%, equities of 30%, real estate of 22% and insurance-linked securities of 4% plus cash of 2%.

Despite negative results in Global Real Estate, we are currently, June 30, 2023 at 3% performance.

In the two focused ESG (sustainability) equity portfolios, we are 0.63% above the benchmark, with one mandate being 1.8% better and the other -0.5% worse (a 6-month comparison is a very short period, but diversification seems to have paid off here as well).

ESG Report 2022

We have had our investments analyzed by PPCmetrics with regard to sustainability. The encouraging results can be found in the ESG report 2022.

Ethos Engagement Pools (EEP)

Our pension fund is a member of the two Ethos Engagement Pools (EEP) Switzerland and International and has been committed to sustainability (ESG) for several years.